President Trump wants to cut taxes for the good of the nation while the Democrats wail “Tax cuts for the millionaires and billionaires!” (gasp)

We say the right cuts will expand the economy and enable America to better serve the world. We are only 4.5% percent of the world’s population, but we have produced 50% of all the food in many years. Our putting 40% of our corn crop into bad motor fuel is starving millions of people.

Food is our greatest defense: Russia will never attack us because we are their “lifeline” when they have crop failures as happens frequently in a country where their grain-growing areas are north of Chicago. Our grain surpluses keep the world grain price down so Russia can afford to feed its’ people in bad years. Starving people replace their governments violently and the Russians know that well as it is much of their history.

The Democrats claim “the rich” are cheating taxes by carrying over loss years. Many projects take more than one year and during that time the property or movie developer has no income. When his payday comes he has been able to spread the income over the several years it took to complete the project which is fair. In the progressive system we have a man getting a paycheck has been taxed in year instead the five it took to make the money! Progressive taxes make development more difficult and that is from where most of our jobs come; from our many small developers and producers.

“Unbiased America’s” Kevin Ryan points out, “during the no income tax time we invented the cotton gin, suspension bridge, fire hydrant, refrigeration, Morse code, sewing machine, combine harvester, steam shovel, circuit breaker, vulcanized rubber, jackhammer, safety pin, paper clip, clothes pin, clothes hanger, dishwasher, electric stove, escalator, vacuum cleaner, repeating rifle, machine gun, torpedo, ratchet wrench, rotary printing press, motorcycle, barbed wire, paper bag, tape measure, sand blasting, grain silo, jeans, fire sprinkler, dental drill, phonograph, central heating, microphone, photographic plate, photographic film, carton, cash register, oil boiler, metal detector, electric iron, electric fan, blood pump, solar cell, thermostat, dissolvable pill, skyscraper, mixer, fuel pump, file cabinet, calculator, induction motor, drinking straw, ball point pen, pay phone, stop sign, cereal, smoke detector, tesla coil, rotary phone, zipper, bottle cap, tractor, mouse trap, surgical gloves, muffler, charcoal briquette, remote control, semi-auto shotgun, airplane, nickel-zinc battery, fly swatter, thumbtack, assembly line, safety razor, hearing aid, air conditioning, offset printing press, windshield wiper, automatic transmission, paper towel, paper shredder, headset, autopilot, electric blanket, traffic lights, and much more.”

The US Patent Office notes: Only one of 1300 US Patents makes more than its’ fees. Does that mean 1299 of the ideas were bad? No, it means the capital and business tax climate were not equitable. Imagine all the new and wonderful things we would have if we were not so highly taxed. We feel that much of high taxation comes from two elements of the elected ruling class, i.e. The Establishment. “Money under the table,” corruption and the thirst for personal power. These are people who want to be applauded wherever they appear. The last thing they want to be is you or me.

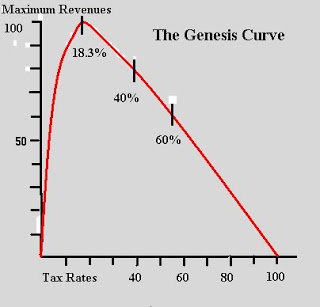

Researcher Dylan Matthews once wrote “Where Does The Laffer Curve Bend” for the Washington Post noting Art Laffer became famous on the idea there is an optimum rate between taxers and payers for an economy to thrive. This is critically important to America as we are only 4.5% of the world’s population, but make half the world’s food, fiber and films.

Matthew’s contribution is that he queried academicians and members of the elected ruling class on the concept. First up was: Dr. Emmanuel Saez, the E. Morris Cox Professor of Economics at UC Berkeley, who wrote:

“The tax rate t maximizing revenue is: t=1/(1+a*e) where a is the Pareto parameter of the income distribution (= 1.5 in the U.S. and easy to measure), and e the elasticity of reported income with respect to 1-t which captures supply side effects. The most reasonable estimates for e vary from 0.12 to 0.40 so e=.25 seems like a reasonable estimate. Then t=1/(1+1.5*0.25)=73% which means a top federal income tax rate of 69% (when taking into account the extra tax rates created by Medicare payroll taxes, state income tax rates, and sales taxes) much higher than the current 35% or 39.6% currently discussed.”

You do not have to be much of a mathematician to tell this is utter nonsense designed to overwhelm. The last thing this guy wants is for you to understand it.

The optimum taxing rate was known in antiquity. When early scribes compiled the Torah, and later the Old Testament, in the first chapter, Genesis 47:26, they wrote “…that Pharoah should have the fifth part…” The scholars of Medieval Europe learned by experiment and called it, “The King’s Fifth.” It was the tax code of Europe until Karl Marx declared success evil.

In 1987 I spent three days in a public library translating “The Statistical Abstracts of the United States” into a constant Dollar base for comparison as the inflation we have suffered since President Wilson reducing the Dollar to a penny, if that, I found the optimum rate is 18.3% by statistical analysis.

When we had that rate our economy expanded 10% to 30% per year. The whole world wants our stuff. Now we are gouged 40% when you sum all taxes and the elected ruling class wants 60%! The result will be a huge decline in revenues, but the elected ruling class will have more through graft. They dream of the day when on their arrivals we fall to our knees screaming, “We are not worthy! We are not worthy!”

Government needs to get out of the way and leave it to the people. This is a truth of antiquity, but our elected ruling class is too stupid or evil to want the best for the people. Truth is in the Genesis Curve.”

Join the conversation!

We have no tolerance for comments containing violence, racism, vulgarity, profanity, all caps, or discourteous behavior. Thank you for partnering with us to maintain a courteous and useful public environment where we can engage in reasonable discourse.